Solax Power DDSU666 CHINT 1-Phase Compensation Meter

Solax Power DDSU666 CHINT 1-Phase Compensation Meter device used to monitor and record electricity consumption in a domestic, commercial or industrial installation.

Solax Power DDSU666 CHINT 1-Phase Compensation Meter

The Solax Power DDSU666 single-phase electricity meter is a device used to monitor and record electricity consumption in a domestic, commercial or industrial installation.

The DDSU666 measures electrical energy consumed over time, allowing users to track their power consumption and monitor system performance.

It could offer remote monitoring capabilities, allowing users to view energy consumption data remotely via a mobile application or online platform.

Designed to be compatible with Solax Power inverters, allowing for simple integration and effective communication between the two devices.

The meter could be designed to be easy to install and configure, minimizing the time and effort needed to start monitoring energy consumption. It could be installed on the wall or other indoor place.

This Chint meter provides the added benefit of allowing the user to be able to observe the power, energy, voltage & current production of their inverter along with a number of other electrical parameters without the need to log on to the SolaX app.

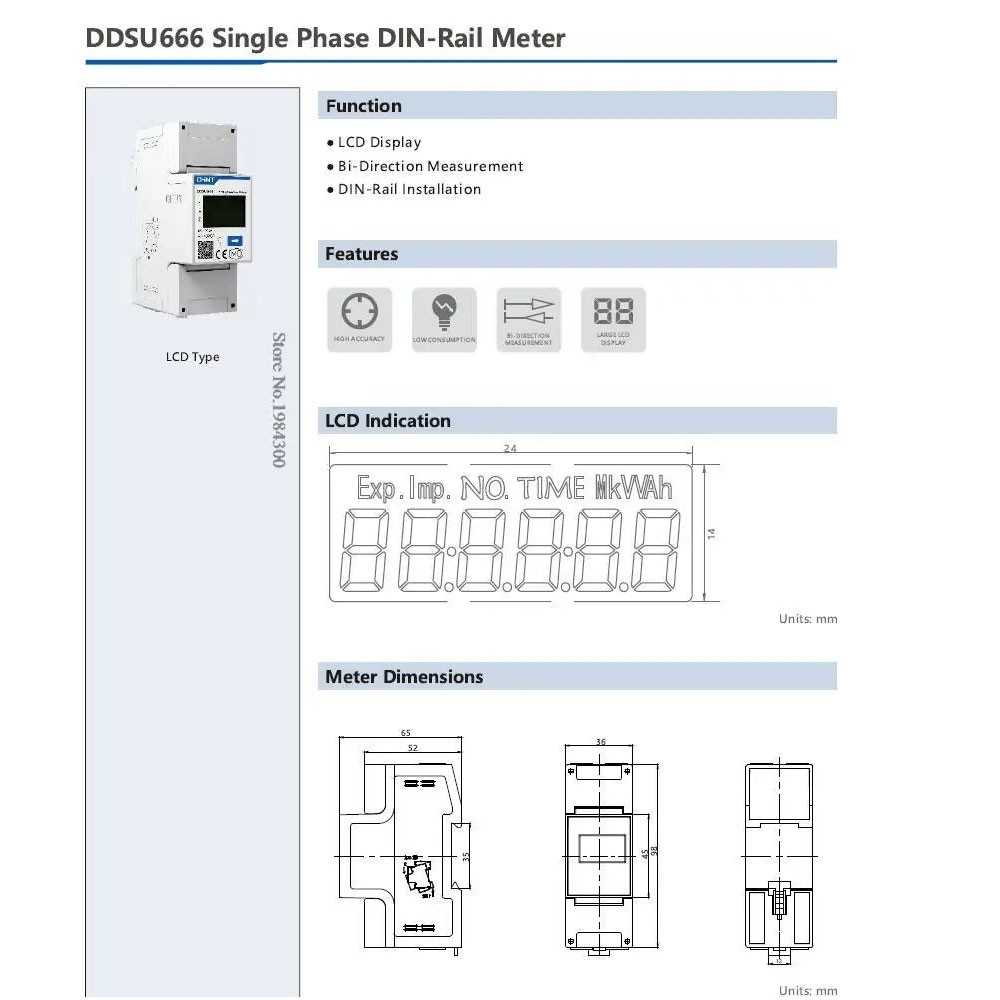

Features:

- Model: DDSU666 CHINT;

- Number of poles: 1P+N;

- Rated current in: 80A;

- Rated voltage: 230/400Vac;

- Rated frequency: 50-60Hz;

- Power dissipated: 1W;

- Number of DIN modules (1 DIN=18mm): 4;

- Degrees of protection: IP54;

- Operation: 1-phase;

- Communication: Modbus, RS485;

- Dimensions: 98x65x36 mm;

- Weight: 0.2 kg.

IMPORTANT NOTE:

The reduced VAT is reserved for PRIVATE INDIVIDUALS, end users and qualified photovoltaic and thermal energy installers or heat production INSTALLED IN ITALY. In case you do not have the right to the tax deduction (DEALERS) kindly contact us in advance so that an invoice with 22% VAT can be issued as per the law in force. In the absence of receipt of the declaration the order cannot be shipped as a copy of the VAT declaration form must by law be attached to the company invoice. The declaration form and ID document must be sent to the email address.

After purchase, kindly complete and return the VAT declaration form together with a copy of an ID document.

10 other products in the same category:

Solis S6-EH3P20K-H 20kW 40000W Three-Phase...

Solis-3P-Meter-CT-3 380V Three-phase meter...

Goodwe GW29.9K-ET 29.9kW Three-phase...

Huawei SUN2000-6KTL-M1 6kW 9000Wp High...

Fronius SYMO ADVANCED 15.0-3-M MPN...

Huawei SUN2000-12K-MAP0 12kW 22000Wp 2MPPT...

Fronius Symo GEN24 8.0 Plus 8kW 3-Phase...

Goodwe GW10KN-ET PLUS 16A 10kW Three-phase...

Reviews (0)